BLOG • Jan 22, 2026

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers

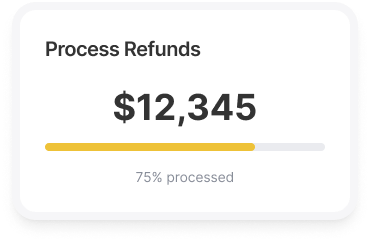

Our team of professionals will ensure that your refund process is compliant with regulations and streamlined for maximum efficiency. Trust us to maintain your financial integrity while saving you time and headaches

Schedule a CallAverage Adjudication Turnaround Time

Approval Rate for Credit Balance Adjustments

Error Rate in Adjudicated Credit Balances

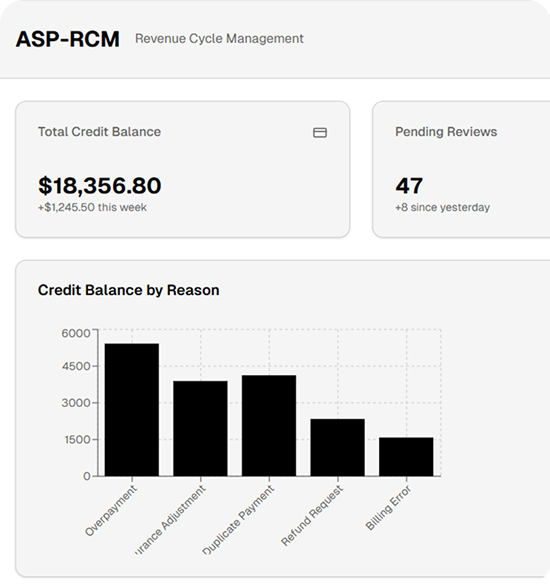

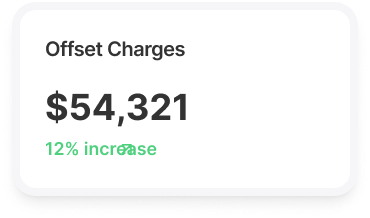

At ASP-RCM Solutions, we understand that managing credit balances is not just a matter of financial housekeeping—it’s about maintaining trust, adhering to regulations, and ensuring the financial health of your practice

ASP-RCM Solutions routinely scans accounts to discover and evaluate these balances. Whether the problem is caused by payer inconsistencies, patient overpayments, or system faults, we treat it with the attention it deserves.

We engage directly with insurers to ensure payment accuracy and determine whether refunds, reprocessing, or other actions are required. This guarantees that all parties are in agreement and that the settlement process moves forward without unnecessary delays

We ensure refunds to patients, payers, or other parties are processed promptly and in full compliance with provided instructions, fostering trust and adherence to payer and patient guidelines

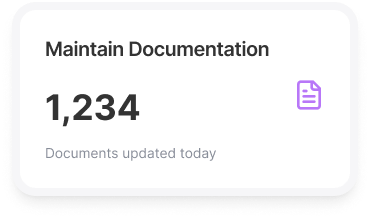

ASP-RCM Solutions maintains detailed records of all credit balance transactions, including investigations, communications, and reimbursements. This ensures a clear, auditable trail that provides peace of mind and ensures regulatory compliance

We conduct regular audits of the credit balance management process to ensure quality, compliance, and alignment with regulatory standards, while identifying areas for improvement and adhering to best practices

At ASP-RCM Solutions, our systematic approach to posting credit balances ensures that every aspect of the process is handled with diligence, accuracy, and transparency

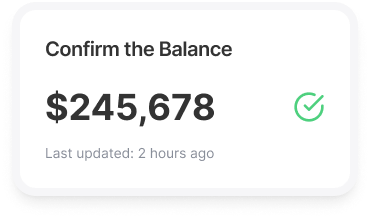

Before taking any action, we verify the existence of a credit balance to ensure accuracy. Verifying balances ensures that subsequent actions are grounded in factual data

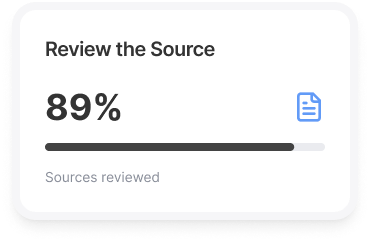

Once a credit balance is confirmed, we examine its source to determine why it exists. This could stem from patient overpayments, payer adjustments, or billing corrections. By thoroughly understanding the origin, we ensure that the credit is legitimate and appropriately resolved

Proper documentation is a cornerstone of our credit balance management process. For every credit balance, we maintain detailed logs that include the source, reason, and actions taken to resolve the issue

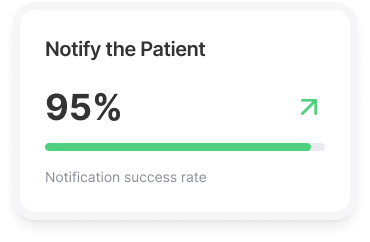

In cases where the credit balance is due to a patient overpayment, we proactively inform the patient and offer resolution options. Clear communication is critical to maintaining trust and satisfaction

If a refund is applicable, we follow established protocols to issue the refund promptly. By acting quickly and accurately, we minimize delays and maintain positive relationships with patients and payers

Denials are managed with precision using Waystars advanced analytics. We identify trends, address systemic issues, and create targeted strategies for specific denial categories. By monitoring outcomes and refining processes, we optimize denial management and improve financial performance

In some cases, credit balances may be applied to future claims as adjustments. Our team carefully tracks and applies these adjustments to ensure compliance and maintain financial accuracy

Periodic reconciliation is essential to maintain financial clarity and prevent discrepancies. We regularly reconcile credit balances to ensure that all accounts are accurate and up to date

.jpg)

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers

BLOG • Jan 22, 2026

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers