BLOG • Jan 22, 2026

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers

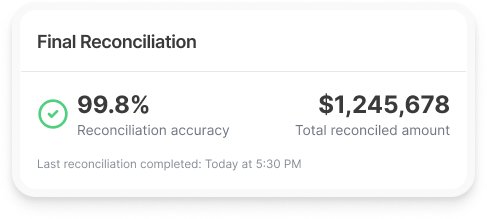

From identifying discrepancies to providing actionable insights for resolution, our solutions offer a start-to-finish process that leaves no room for error

Schedule a CallTransaction Accuracy Rate

Reconciliation Completion Time

Exception Resolution Rate

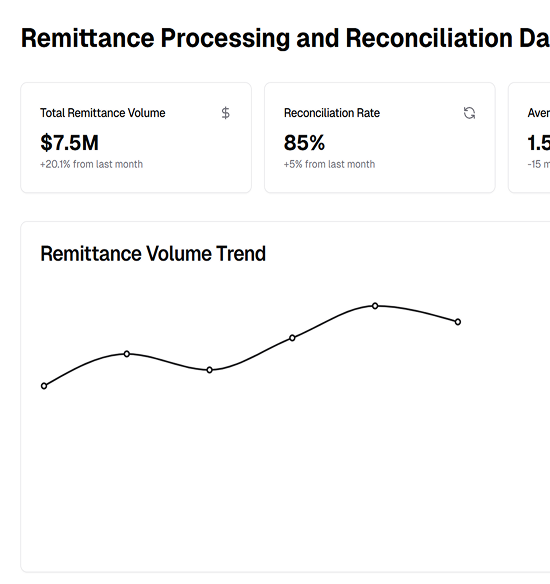

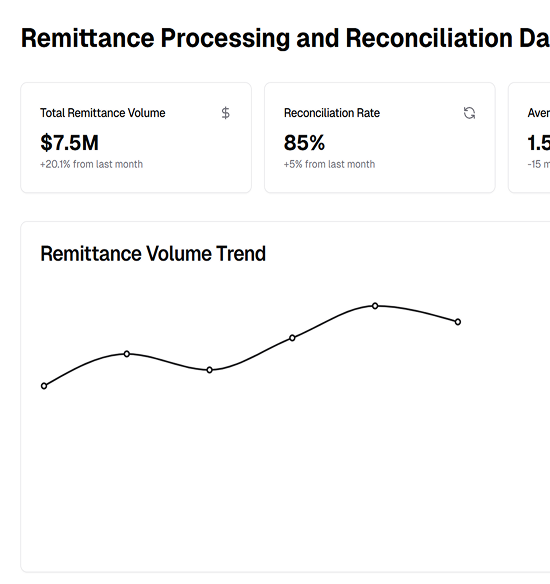

Modern remittance processing and reconciliation systems come with cutting-edge features that address the complexities of today’s business environments

Automation eliminates manual data entry, reducing errors and ensuring payments are processed faster and with greater accuracy. Scalable systems can handle increasing transaction volumes effortlessly, supporting business growth while cutting operational costs

Modern remittance systems provide instant updates, reflecting payments across systems as soon as they are received. This enables finance teams to monitor cash flow, make proactive decisions, and allocate resources effectively in real time

Sophisticated algorithms swiftly detect and resolve payment errors like mismatches, duplicates, and missing data, ensuring time savings, loss prevention, and data integrity for businesse

Integration with accounting and ERP systems automates payment data syncing, reducing manual entry, streamlining workflows, and improving financial reporting and compliance

Modern systems offer robust security features like encryption and multi-factor authentication to protect financial data. Real-time monitoring detects suspicious activities, ensuring secure and compliant operations

Remittance processing and reconciliation follow a structured workflow designed to optimize accuracy and efficiency

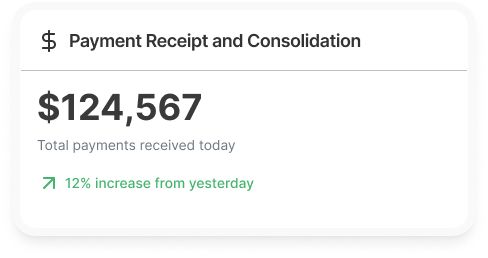

Payments are received through various channels, including digital methods like ACH, wire transfers, and credit cards, as well as physical methods such as checks, cash, and invoices. These payments are then consolidated into a centralized platform, streamlining the initial stages of processing

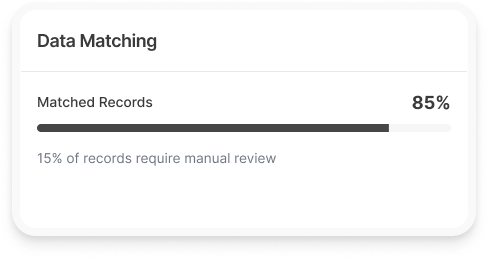

Once payments are captured, they are automatically matched to their corresponding invoices or accounts receivable records. Advanced systems utilizing AI and machine learning handle complex matches and flag exceptions, ensuring high levels of accuracy while minimizing manual intervention

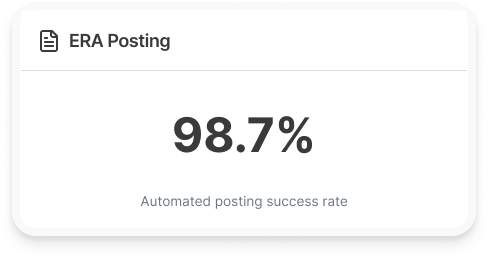

ERA files are imported into the revenue cycle system, offering an automated way to post payments. During this process, any exceptions or discrepancies are diligently identified and corrected to ensure smooth financial entries and balanced records

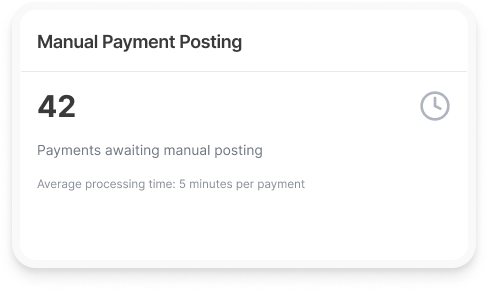

For payments requiring manual intervention, details from Explanation of Benefits (EOBs) are carefully captured and posted line by line to the respective patient accounts. This process adheres to practice-specific and physician-specific business rules, ensuring precise adjustments, write-offs, and balance transfers

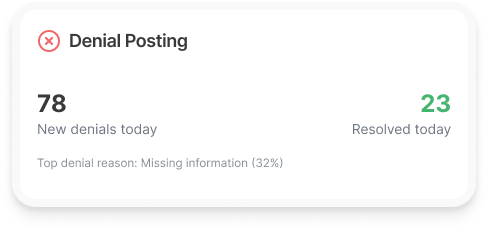

Denied claims are efficiently routed into appropriate work queues based on ANSI denial codes and payer-specific remark codes. These claims are then addressed through further actions, such as re-billing secondary payers or transferring balances to patient accounts, maintaining the integrity of the revenue cycle

Patient payments, whether received via point-of-service cash collections, checks, or credit cards through patient portals, are meticulously processed. Pending balances are transferred to secondary insurers, when necessary, while any credit balances are promptly resolved to maintain accurate financial reporting

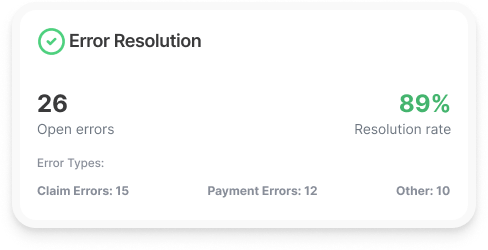

Discrepancies, such as missing or mismatched payments, are flagged for immediate review. Automated systems drastically reduce the time and effort needed for investigation, ensuring that errors are corrected quickly and efficiently, preserving data accuracy

Once all payments are matched and discrepancies resolved, the reconciliation process ensures that the financial ledger accurately reflects all transactions. Comprehensive reports are generated to provide stakeholders with clear and transparent insights, enabling better decision-making and accountability

.jpg)

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers

BLOG • Jan 22, 2026

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers