BLOG • Jan 22, 2026

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers

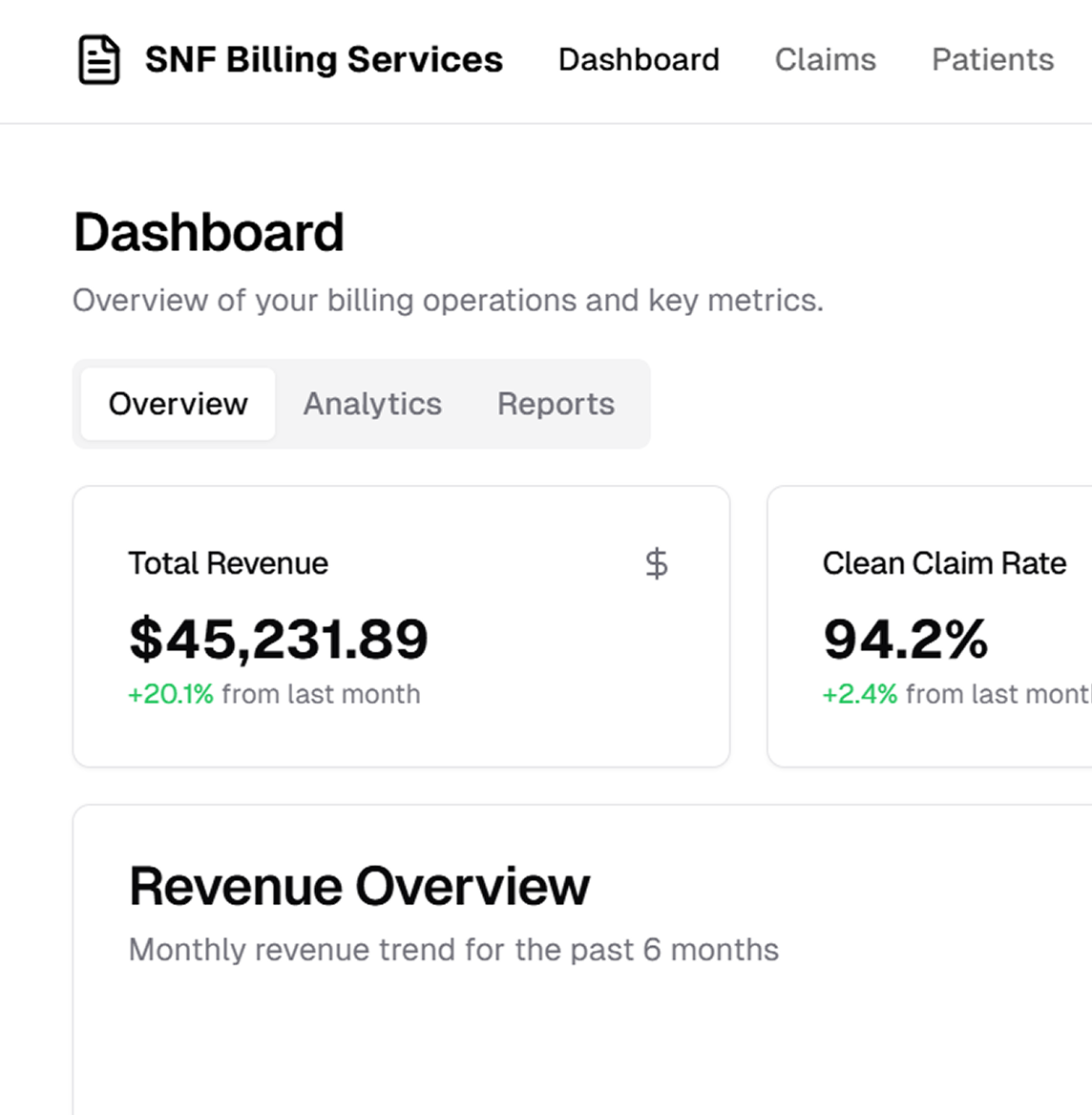

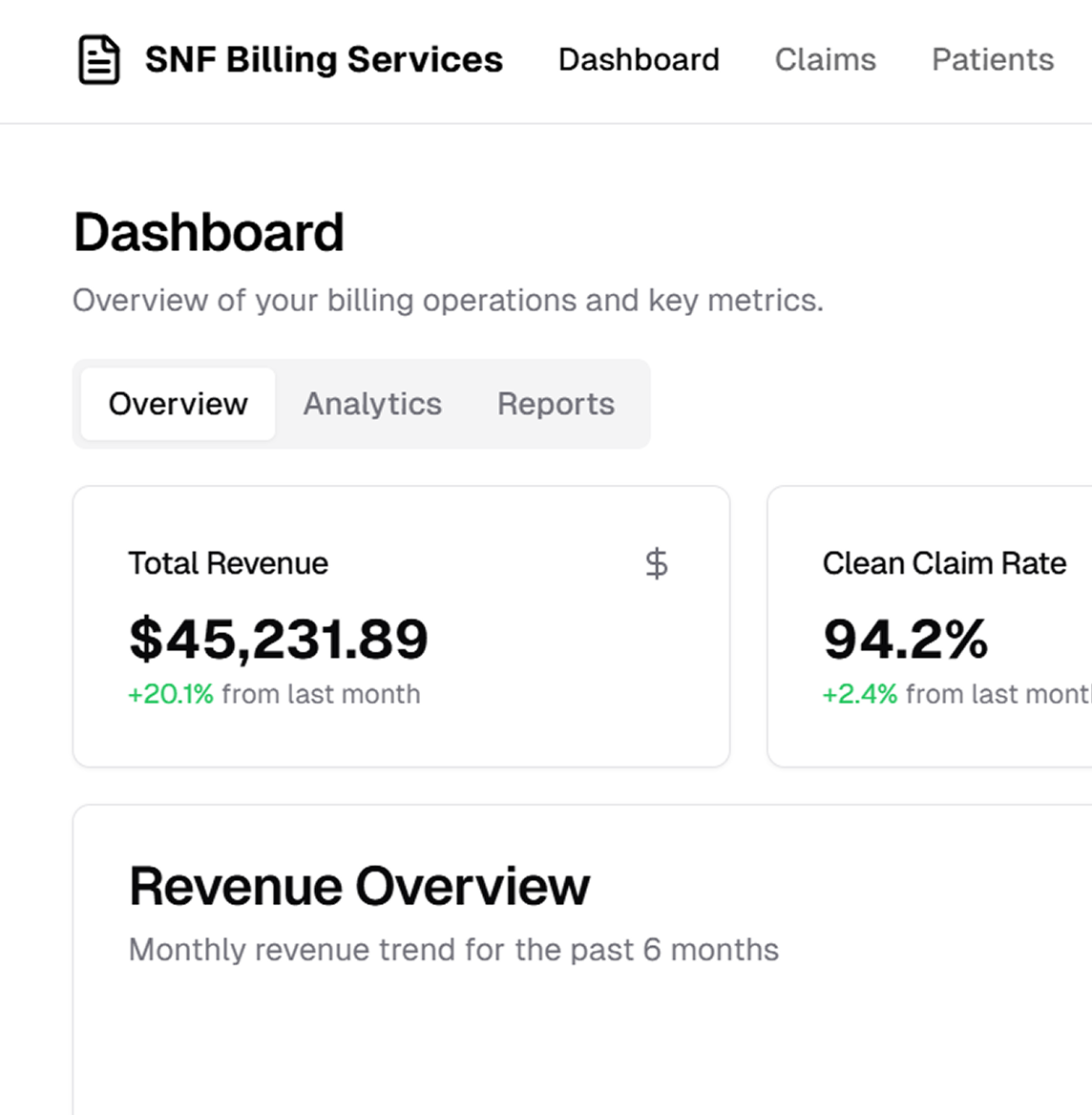

Billing services for nursing homes & long‑term care facilities that are fast and powerful

Schedule a CallTotal Patient Days Billed

Average Payment Cycle

Claims Underpayment Rate

Skilled nursing home billing supports continuous medical or nursing care for residents, including individuals with disabilities or illnesses. It requires expertise from qualified health personnel—registered nurses, licensed practical nurses, physical therapists, occupational therapists, and speech‑language pathologists—and typically covers ongoing conditions ordered by a physician

Medicare coverage for nursing facilities often involves shifting restrictions that can complicate reimbursements. Even the smallest coding error can result in lost payments. Our specialized billing approach precisely records and documents every claim, following it through until you receive full compensation

• Consolidated Billing Requirements: SNFs must understand what Medicare A covers (and what it does not). Uncovered services under Medicare A might still be billable under Medicare B; recognizing these details is crucial. • Per Diem Payments: SNFs are reimbursed a fixed daily rate under Medicare A, which they must use to pay contracted service providers. • Prospective Payment System (PPS): Under PPS, SNFs submit a consolidated claim to Medicare A for per diem reimbursement, requiring careful adherence to coverage rules.

• Authorization or referral issues • Out‑of‑network claims and deductibles • EDI rejections or wrong diagnoses • PIP (Personal Injury Protection) cases • Terminated insurance or COB (Coordination of Benefits) problems

• Inaccurate coding leads to claim rejections. • Limited clarity on which services are covered by Medicare A vs. Medicare B. • Fixed or per diem payments do not always cover actual costs. • Rejected claims and underpayments resulting in revenue leakage. • Difficulty documenting all necessary medical and non‑medical activities for reimbursement.

• Authorization or referral issues • Out‑of‑network claims and deductibles • EDI rejections or wrong diagnoses • PIP (Personal Injury Protection) cases • Terminated insurance or COB (Coordination of Benefits) problems

By centralizing every aspect of the revenue cycle—from claim submission to final payment—we help sustain facility profitability while keeping patient care at the forefront

We excel at managing a spectrum of skilled care claims (Medicare Part A, Part B, replacements, and commercial plans), driving both successful reimbursement and process improvements

Our team expertly handles Medicaid applications, Hospice billing, and Medicaid Coinsurance (MXA), ensuring no eligible service goes unbilled and no reimbursement opportunity is missed

We go beyond standard billing. Our services include managing trust funds, handling aging clean‑up, processing resident communications, and taking care of private pay collections, payment posting, and Medicaid applications

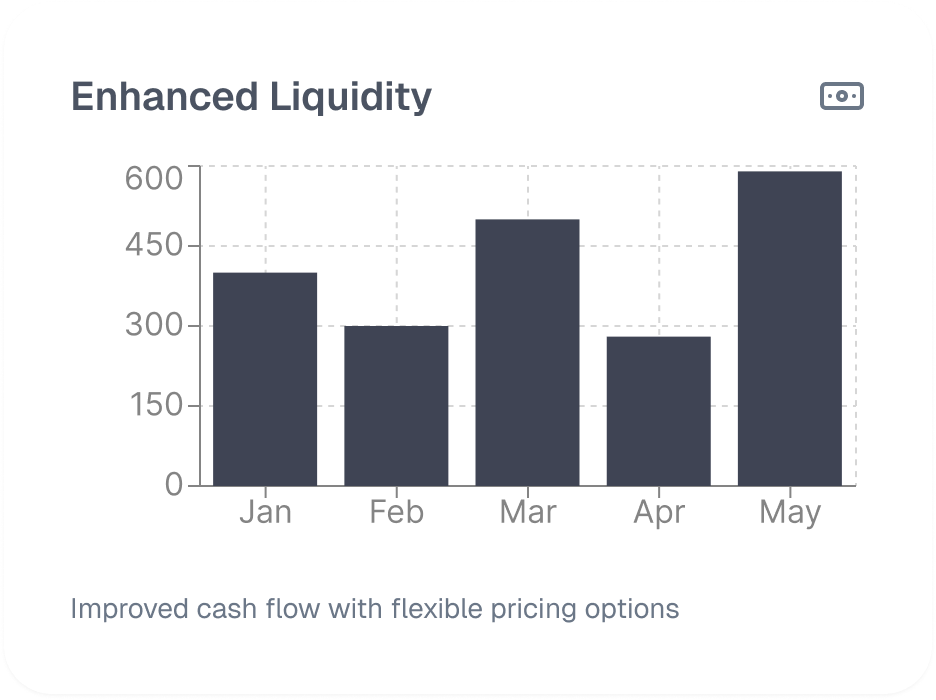

Whether you need a flat monthly fee, commission‑based structure, or hourly charges, ASP‑RCM provides long‑term solutions for billing, collections, business office support, and specialized past‑due collection projects

Our dedicated denial management strategies address authorization lapses, coding errors, out‑of‑network issues, and more. By analyzing root causes and implementing proactive solutions, we reduce AR days and increase revenue capture

We monitor evolving Medicare regulations, payer policies, and SNF guidelines to refine processes regularly. This ensures you remain compliant, competitive, and prepared for new mandates—all while safeguarding your revenue stream

.jpg)

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers

BLOG • Jan 22, 2026

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers