BLOG • Jan 22, 2026

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers

Our services help you identify the root cause of claim denials, analyze them efficiently, and resolve them quickly to optimize your income and financial performance. Let us help you take control of your claims management process

Schedule a CallA/R Aging Over 90 Days

Denial Rate

First-Pass Resolution Rate

Efficient AR and denial management are vital for the financial health of any organization. Here Why:

We leverage cutting-edge technology to automate billing, posting, and denial tracking processes, significantly reducing manual effort and errors

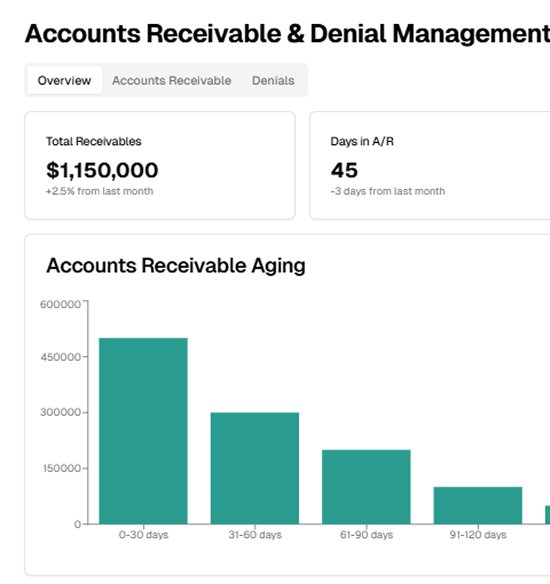

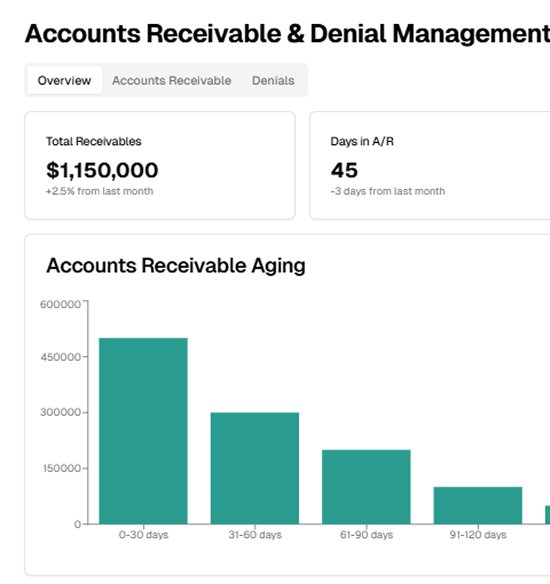

Our dashboards provide a clear view of your AR aging, denial trends, and payment performance, empowering you to make data-driven decisions

From prioritizing accounts to routing denied claims for follow-up, our tailored workflows ensure maximum efficiency

Our systems seamlessly connect with payer portals and patient engagement tools, speeding up collections and resolving payment issues effectively

Our tailored strategies and technology-driven solutions address these challenges head-on to optimize outcomes for your organization

Our tailored strategies and technology-driven solutions address these challenges head-on to optimize outcomes for your organization

Common hurdle that can severely disrupt cash flow when left unaddressed. At ASP-RCM, our experts proactively identify neglected claims and log into payer systems to retrieve the latest status updates, review the issues causing delays, and take corrective actions. By resolving these claims promptly, we minimize the risk of revenue loss and ensure steady cash flow

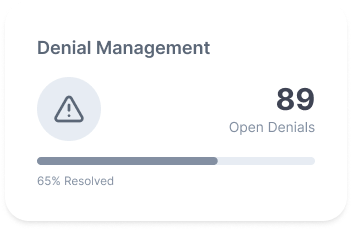

Denial management is a key challenge in revenue cycle management, often causing lost reimbursements. Our team analyzes denial documents to pinpoint issues like coding errors, missing documentation, or eligibility mismatches. We resolve current denials and implement preventive strategies, ensuring higher first-pass resolution rates and streamlined revenue collection

plays a vital role in streamlining claims submission, tracking, and follow-ups. By leveraging real-time data from clearinghouses, we ensure accurate submissions and quicker payer responses. Our integration process also identifies and resolves claim rejections at the clearinghouse level, providing complete visibility into the claim lifecycle and enabling timely interventions

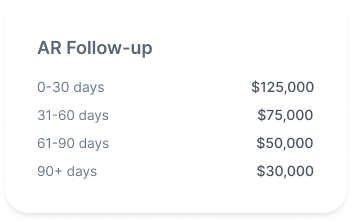

Managing aging claims and pending payments is vital. Our disciplined follow-up process tracks claims consistently, prioritizing high-value and time-sensitive accounts. By resolving issues directly with payers, we expedite payments and boost revenue recovery for your organization

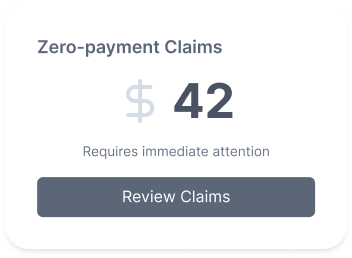

This process requires a detailed investigation to prevent revenue loss. Our team identifies causes for zero remittance, such as contractual adjustments, coding errors, or payer rejections. We provide necessary documentation, corrections, and resubmit claims when needed, ensuring rightful reimbursement and maximizing revenue recovery

Denials are managed with precision using Waystars advanced analytics. We identify trends, address systemic issues, and create targeted strategies for specific denial categories. By monitoring outcomes and refining processes, we optimize denial management and improve financial performance

An essential part of accounts receivable management, we meticulously review Explanation of Benefits (EOBs) to ensure payment accuracy, reconcile claims, and update patient accounts with adjustments or transfers. This maintains financial transparency and eliminates discrepancies

Appeals help recover denied claims and boost reimbursements. Our thorough process includes gathering strong documentation, providing clarifications, and engaging payers effectively. This maximizes claim amounts and reduces lost revenue

.jpg)

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers

BLOG • Jan 22, 2026

Medicare 2026: Essential Coverage Changes for Seniors and Healthcare Providers